Some Known Details About Accountants

Wiki Article

Getting My Certified Cpa To Work

Table of ContentsAccounting Fresno for Beginners9 Easy Facts About Fresno Cpa ExplainedThe smart Trick of Fresno Cpa That Nobody is DiscussingAn Unbiased View of AccountantsThings about Certified Accountant

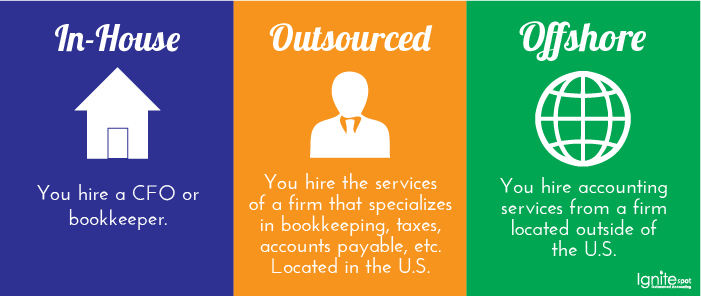

If you discover you might be paying too a lot for an in-house accounting professional. Outsourcing your accountant can assist you maintain your company agile no issue what economic or societal changes happen around you.We have all of the knowledge you're looking for from pay-roll to organization development that can aid your firm thrive.

CPAs are accounting professionals that are tax professionals. Prior to you begin your organization, you should meet with a CPA for tax obligation guidance on which service framework will conserve you money and the bookkeeping method you ought to use. If you're audited, a certified public accountant can represent you before the IRS.As a little company owner, you might find it difficult to gauge when to contract out duties or manage them on your very own.

While you can definitely deal with the day-to-day audit on your own particularly if you have good audit software program or work with an accountant, there are circumstances when the know-how of a certified public accountant can assist you make sound organization choices, prevent pricey blunders as well as conserve you time. Certified public accountants are tax specialists who can file your organization's tax obligations, response crucial economic concerns and possibly conserve your company cash.

Rumored Buzz on Fresno Cpa

This implies Certified public accountants are legally needed to act in the very best rate of interest of their customers, whereas a standard accountant does not have a certificate to lose. A CPA is also an accountant, however just about 50% of accountants are likewise licensed Certified public accountants. CPAs can use several hats for your small company.

g., tax obligation records and profit-and-loss statements), monetary preparation and also tax declaring, among other tasks. They can likewise offer sound monetary advice for your company as you remain to expand, so you can focus on running your company. These are the general duties you can get out of a CPA: CPAs are certified to deal with all of your service tax obligation requirements, consisting of year-round recordkeeping and also filing tax extensions with the IRS.If you are investigated, Certified public accountants can lower the expense of audit searchings for by bargaining with the internal revenue service on your part.

Certified public accountants can help you with essential financial choices, budgets, economic threat management issues, and various other economic services. They can additionally supply important guidance on complicated economic matters. CPAs can help check your books and also avoid fraudulence. If you're not currently utilizing top pay-roll software application, Certified public accountants can establish your organization up with a platform that benefits your business.

Some Known Incorrect Statements About Accountants

In addition to accounting as well as pay-roll, a certified public accountant helps with tax guidance, preparation as well as conformity. They can additionally speak with you on your spending plan as well as other intricate financial matters. The brief response is that it depends mostly on your organization as well as the solutions you require. According to the U (fresno cpa).S. Bureau of Labor Stats, the median per hour wage for CPAs is $40.It is very important to have a concept of the sort of services you need prior to you meet a potential certified public accountant. In this manner, you can have a clear conversation on exactly how they are mosting likely to bill you. By detailing costs, you can acquire a realistic suggestion of how the certified public accountant can help browse around this web-site your organization grow.

While it's difficult to select a concrete number for just how much you can expect to pay a CERTIFIED PUBLIC ACCOUNTANT, it is necessary to have a knowledge of regular fees and costs. These are some normal expenditures to evaluate before you satisfy with a CERTIFIED PUBLIC ACCOUNTANT: Per hour prices, Management fees, Paperwork fees, Other charges as well as solutions The national average wage for a certified public accountant is $40 per hr.

You do not always require to hire a certified public accountant as a permanent or perhaps part-time staff member to gain from their knowledge of the ins and outs of organization finance, as many provide their services as professionals. These are times you should take into consideration working with a CERTIFIED PUBLIC ACCOUNTANT: When you're releasing a business and money is limited, view the suggestion of paying thousands of bucks for a couple of hours with a certified public accountant may seem extravagant.

Little Known Questions About Fresno Cpa.

A Certified public accountant can aid you set up your business so you can avoid costly blunders.:max_bytes(150000):strip_icc()/Accounting-FINAL-e01e0f2d93264a989c19357a99d7bffd.jpg)

Certified public accountants can prepare tax obligation records, data tax returns, as well as strategize methods to decrease your tax obligation obligation for the list below year. Likewise, Certified public accountants can represent you if the IRS has inquiries regarding your return or if you or your service are examined, which is a vital consideration. Business taxes are different from individual tax obligations; even if you have actually constantly done your taxes yourself, you may intend to work with a CPA if your tax scenario is complex.

These are other ways Certified public accountants can aid you with your tax obligations: CPAs help you comprehend and adhere to tax modifications. When the tax obligation code adjustments, such as it finished with the Tax Cuts and also Jobs Act, a certified public accountant can assist you comprehend if as well as just how the changes affect your company.

Not known Details About Fresno Cpa

While you want to take as many deductions as you're qualified to, you also don't desire to make questionable deductions that may cause an audit. A CPA can assist you determine when you ought to or should not take particular deductions - accounting fresno. These are some circumstances when you where can i see the accountant might need a certified public accountant's guidance: You're beginning a service as well as require to know which startup prices are insurance deductible.

Your home and small company intermingle, and you're not exactly sure which expenses are insurance deductible. Can you subtract your residence workplace if you additionally have a workdesk at another place? If your vehicle is mainly utilized for work, should you or your service have it? Is your cellular phone an overhead? If you take a company trip as well as prolong it for a few getaway days, which expenses can you subtract!.?. !? As you run your organization, there might specify circumstances when you require a CPA's know-how.

Certified public accountants have experience taking care of the IRS as well as can aid you react suitably, provide the information it needs, as well as resolve the issue as painlessly as possible. These are a few other circumstances that might prompt you to work with a CPA: If you're considering taking out a tiny service financing, a CPA can help you choose if funding fits your long-lasting goals.

Report this wiki page